Money matters can be a tricky topic for couples, but it doesn't have to be. Imagine an app that simplifies your finances, keeps both of you in the loop, and helps you save for your dream vacation, car, or even a house. Sounds great, right?

Well, such apps do exist! This blog post is all about the best budget apps specially designed for couples.

These apps are easy to use, affordable, and most importantly, they promote transparency and financial harmony.

So, if you're ready to take control of your joint finances, keep reading. Trust us, your wallet will thank you!

What are Budget Apps For Couples?

Budget apps for couples are digital tools that can help you and your partner manage your money together.

They're designed to make budgeting easier, more transparent, and collaborative. With these apps, you can link your bank accounts, track your spending, and set joint financial goals.

Some even allow you to view each other's transactions while still maintaining some level of privacy.

Additionally, they can provide valuable insights into your spending habits, helping you identify areas where you can save.

Whether you're saving for a house, planning for a trip, or just aiming to reduce debt, these apps are a game-changer.

They're not just about budgeting, they're about fostering financial communication and cooperation between partners.

Top Budget Apps For Couples

Let's now take a look at some popular budget apps that have proven to be effective for couples:

1. Goodbudget

Goodbudget is a practical budgeting tool that simplifies managing your money. It works by letting you divide your income into 'envelopes' for different spending areas - this way, you can track expenses and avoid overspending.

Goodbudget stands out as a great option for couples. Its virtual envelope system allows partners to share and sync budgets, making joint financial planning easier.

By allocating shared funds into categories like groceries, date nights, or credit card bills, couples can have clear visibility of their spending.

This level of transparency helps avoid financial surprises and encourages open discussions about money, fostering better financial harmony.

2. Tiller

Tiller is a unique budgeting tool designed for couples comfortable with spreadsheets. Instead of being an app, it integrates with familiar platforms like Excel and Google Sheets.

This makes Tiller a great choice if you prefer working with these programs.

Tiller simplifies financial management by automatically updating your financial data, reducing manual entry. Its pre-made sheets provide a flexible platform for tracking various aspects of your finances.

You can monitor expenses, income, net worth, personal budgets, and account balances.

Tiller's compatibility with common spreadsheet programs makes it a convenient and efficient tool for couples to manage their shared finances.

3. YNAB

YNAB, short for You Need A Budget, is a fantastic budgeting tool designed for couples starting from square one. It uses a unique Four Rule method that aims to transform your financial habits.

The secret behind YNAB's success is its zero-based budgeting approach. Essentially, it encourages you to plan for every dollar earned.

The four rules - assigning each dollar a purpose, planning for expenses, adapting to changes, and letting your money age - form the core of this method.

These rules help couples control their finances effectively, fostering healthier money management practices. Plus, YNAB offers a free 34-day trial, so you can give it a go without any commitment.

4. Personal Capital

Personal Capital stands out among budget apps with its broad suite of financial planning tools. It's an excellent choice for couples seeking comprehensive financial management.

With this app, managing your budget becomes easy by tracking various portfolio balances. It provides a holistic view of your finances through specialized software in different areas.

From planning savings, retirement, and education, to checking investments and analyzing fees, Personal Capital covers it all.

It even offers a financial roadmap, personal strategy, employer plan analysis, and a smart withdrawal feature.

This wide range of services makes Personal Capital a one-stop solution for couples looking to improve their finances.

5. Mint

Mint is a free budgeting tool perfect for couples who wish to consolidate their bank accounts for better spending oversight.

Mint enables you to link multiple accounts, eliminating the need for separate apps and providing a comprehensive view of your finances.

Its features enhance financial management for couples. It gives timely bill reminders and alerts for any subscription price hikes.

You can customize budgets according to your needs and gain insightful spending tips. Additionally, it provides free credit score updates.

With Mint, couples can seamlessly track and budget their spending, leading to more informed financial decisions.

6. Monarch

Monarch is a user-friendly financial app ideal for couples seeking to consolidate all their accounts and investments in one place.

Monarch simplifies finance management by offering a unified platform where you and your partner can track all your accounts.

It's compatible with over 11,000 banks and financial institutions, eliminating the need to switch banks.

From tracking accounts to receiving personalized advice and setting long-term financial goals, Monarch has it all.

It even sends alerts if you exceed your customized spending limits. With Monarch, managing finances becomes a breeze for couples.

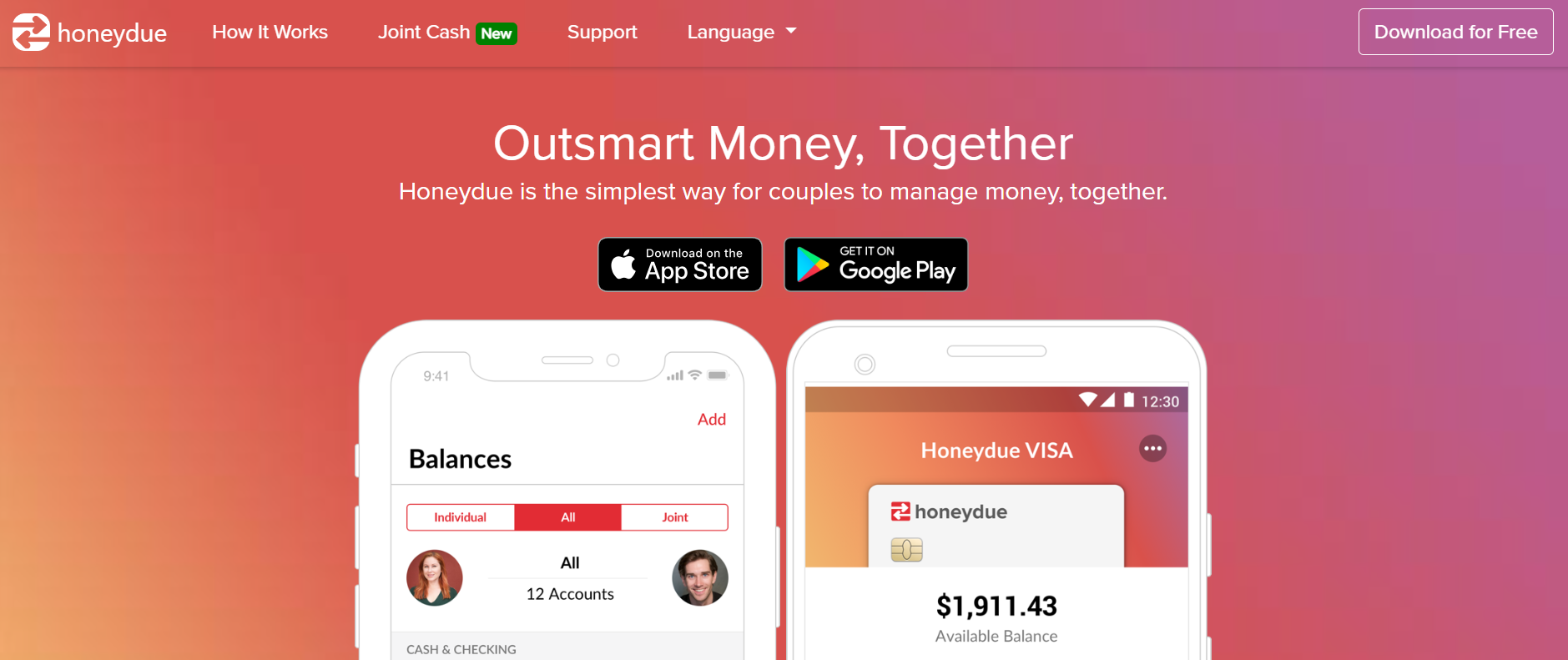

7. Honeydue

Honeydue, a budgeting app specially designed for couples, simplifies money management by offering unique features tailored for two.

With Honeydue, you can easily sync your financial accounts, track transactions, and even open joint bank accounts.

It supports connections with over 20,000 financial institutions across five countries, allowing you to link bank accounts, loans, and investment accounts seamlessly.

The app also helps you stay on top of your bills, sending timely reminders to prevent late payments. A standout feature is the in-app chat, which encourages meaningful financial discussions between partners.

The best part is that Honeydue is a completely free app, making it an excellent option for couples looking to manage their finances without any additional costs.

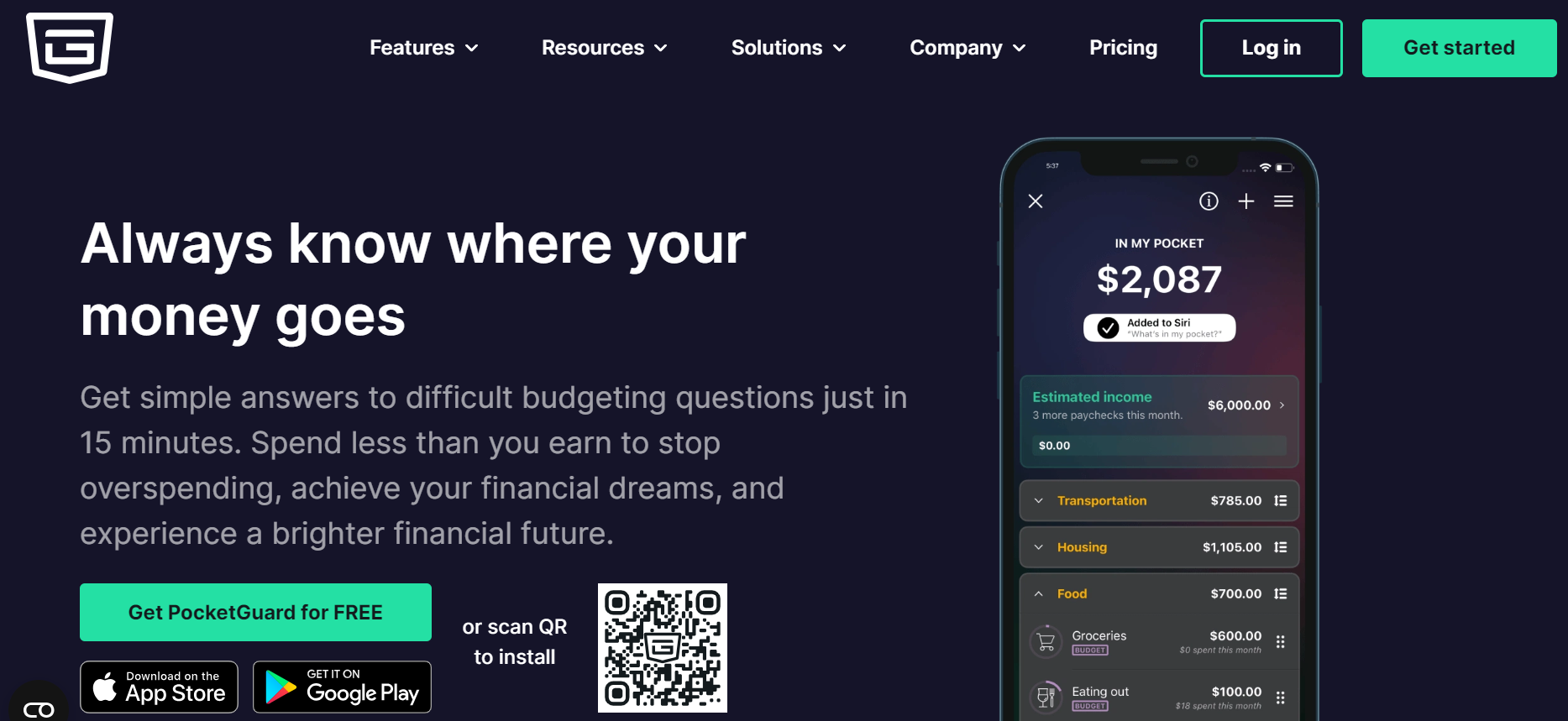

8. PocketGuard

PocketGuard is a budgeting app with unique features that cater specifically to couples. With PocketGuard, couples can manage their finances together by using the same login details on different devices.

The app offers free features like financial account syncing, bill and income tracking, insights, spending reports, cash tracking, and basic budgeting.

For those needing more, the Plus plan provides access to debt payoff plans, unlimited budgets, and savings goals, as well as extended transaction history and data storage.

PocketGuard is an excellent choice for couples looking to streamline their financial management without complexity.

9. Everydollar

EveryDollar is an efficient budgeting app that simplifies financial management. EveryDollar is a user-friendly app that allows you to craft your budget, track savings, and set bill due dates for free. It also provides a feature to split transactions.

With a premium upgrade, it offers bank sync for real-time transaction tracking and one-click transaction confirmation.

Custom income and spending reports provide insights into your financial habits, while tracking recommendations help optimize your budget.

The app also lets you monitor your goal progress, ensuring you stay on track. In simple terms, EveryDollar is a valuable tool for anyone looking to take charge of their finances.

10. Simplifi

Simplifi offers an uncomplicated way for couples to manage their finances together. It allows you to link various financial accounts, set savings targets, and track your spending.

With Simplifi, you can also create spending budgets and assess your progress, making it easier to adjust your financial strategies as needed.

Whether you have individual or joint accounts, Simplifi supports couples in their shared financial journey.

This app is also known for its easy-to-understand interface and comprehensive budgeting features, making it a top choice for couples.

What are the Benefits of Using Apps For Couples?

There are many benefits to using budget apps for couples, including:

1. Improved Communication

Relationship apps are a boon for couples striving for better communication. They offer an easy and convenient platform to share thoughts, plans, and feelings, bridging any communication gaps.

These apps come with features like chat options, shared calendars, and reminders that keep both partners on the same page.

This direct and open communication leads to better understanding, and mutual respect, and strengthens the bond between couples.

2. Enhanced Relationship Quality

Apps designed for couples, like 'Paired', play an integral role in enhancing the quality of relationships. With regular usage, these apps can bring about significant improvements.

They provide relationship tips, daily questions, and quizzes that provoke thought and encourage deeper conversations.

They also help couples understand each other better, resolve conflicts, and nurture their relationship. Over time, this consistent effort can lead to a stronger, healthier, and more fulfilling relationship.

3. Organized Life Together

Managing shared responsibilities and tasks can sometimes become overwhelming for couples. That's where apps come to the rescue - they help couples stay organized and manage their day-to-day tasks efficiently.

From setting reminders for grocery shopping to scheduling date nights, these apps handle it all. They act as a shared digital space, making life easier and less stressful.

By simplifying coordination and planning, these apps allow couples to focus more on enjoying their time together.

4. Increased Teamwork

In any relationship, teamwork is key. Apps for couples are designed to foster this. They encourage partners to make decisions together and solve problems jointly.

These apps offer features like shared to-do lists or decision-making tools that require both partners' input.

This not only promotes cooperation but also ensures both partners feel valued and involved. It strengthens the bond between couples, reinforcing their partnership and making their journey smoother.

5. Fewer Financial Disputes

One of the most common causes of arguments in a relationship is money. By using budget apps, couples can eliminate this problem and reduce financial disputes.

With all financial information in one place, partners can easily track expenses, set budgets, and monitor their progress toward joint goals.

Moreover, these apps provide real-time updates on each other's spending habits, promoting financial transparency and accountability. This helps prevent overspending and promotes a healthier financial dynamic in the relationship.

6. Boosting Digital Health and Well-being

In the digital age, technology can significantly influence our well-being. Relationship apps are a prime example. They not only help manage tasks and communication but also contribute to mental health.

Through prompts for self-reflection, relationship advice, and stress management tips, these apps can boost overall well-being.

They create a positive and supportive virtual environment that can improve mood, reduce stress, and ultimately enhance the quality of relationships.

How to Find the Best Budget App For Couples?

Just like any app, it's essential to consider your specific needs and preferences when choosing a budget app for couples - here are some factors to consider:

1. User-Friendliness

When choosing a budget app for couples, the ease of use is a crucial factor to consider. The app should have a clean, intuitive interface that makes it simple to navigate.

It should allow easy entry of income and expenses, and display financial information in a clear, understandable manner.

The less time you spend figuring out how to use the app, the more time you can dedicate to managing your finances effectively.

2. Shared Access

Shared access is another important feature for a couples' budget app. Both partners should be able to access the app simultaneously, view financial data, and make updates as needed.

This promotes transparency and ensures both partners are equally involved in managing their shared finances. It also allows for real-time updates, so there's no confusion about the current state of your budget.

3. Expense Tracking

A critical feature of a good budget app is its ability to track expenses. The app should be capable of categorizing your spending into different areas like groceries, utilities, entertainment, and more.

This helps you understand where your money is going and identify any problematic spending habits.

Moreover, the app should allow for real-time expense tracking, so you can always have an accurate picture of your financial situation.

4. Budgeting Tools

Budgeting tools are another essential component of a reliable budget app. These tools should help you create a realistic budget based on your income and expenses.

They should also provide alerts when you're close to exceeding your spending limit in a particular category.

Such features promote financial discipline, helping you stay within your means and work towards your financial goals efficiently.

5. Bill Reminders

One of the most beneficial features of a good budget app is bill reminders. These alerts can help prevent late payments and the resulting fees.

The app should allow you to schedule reminders for all your recurring bills, such as rent, utilities, or credit card payments.

This feature not only helps you avoid unnecessary costs but also ensures you maintain a good credit score by making timely payments.

6. Compatibility

When choosing a budget app, it's important to consider its compatibility with your devices. Whether you're an Android user or an iPhone enthusiast, the app should work seamlessly on your preferred device.

Moreover, if you often switch between a tablet, phone, and computer, the app should support multi-device access. This way, you can manage your finances conveniently, no matter what device you're using.

7. Security

In today's digital age, security has become more important than ever. When it comes to a budget app, the security of your financial information is paramount.

The app should employ strong encryption methods to protect your data from theft and damage.

However, almost every budget app has good security measures in place- but it is still a good idea to double-check it before downloading.

8. Reviews and Ratings

Before deciding on a budget app, it's wise to check out its reviews and ratings.

These provide valuable insights into the experiences of other users, helping you gauge the app's reliability, performance, and user-friendliness.

High ratings and positive reviews are generally a good sign, indicating that the app delivers on its promises.

However, don't just focus on the overall score. Read through individual reviews to understand any potential issues or standout features.

9. Customer Support

According to various sources, including Hubspot and Mailchimp, excellent customer support is a crucial element of any service, including budget apps.

It serves as the direct link between the user and the provider, fostering loyalty and retention.

A good budget app should provide prompt and efficient customer service to address users' concerns and queries.

This can be achieved through various channels like email, chat, or phone support, ensuring users get the help they need when they need it.

10. Cost

The cost of the budget app is another significant factor to consider. While many apps offer basic features for free, premium versions usually come with advanced functionalities.

However, it's essential to ensure that the cost aligns with the value provided by the app.

An expensive app that doesn't deliver on its promises can be a waste of money, while a reasonably priced app with robust features can be a sound investment.

Always weigh the app's cost against its features and benefits before making a decision.

Conclusion

Being a couple means sharing your life and resources with someone else, including finances.

With these top budgeting apps for couples, you can simplify your financial management and work towards achieving your shared financial goals.

From tracking spending to planning for retirement, these apps have got everything covered. So make sure to do your research and choose the best app that suits your needs as a couple.