Let's face it, managing money can be a real headache, especially when you're juggling bills, grocery lists, school fees, and those unexpected expenses that pop up from nowhere - but it doesn't have to be this stressful.

What if we told you there's a way to keep your family's finances on track without breaking a sweat? You're in luck because we've rounded up the best budget apps for families that make money management a breeze.

These apps are easy to use, effective, and most importantly, friendly on your wallet. So, buckle up as we dive into the world of budgeting made simple. Let's go!

What are Budgeting Apps?

Budgeting apps are digital tools designed to help you manage your money effectively. They allow you to track your income, expenses, and savings all in one place.

With these apps, you can create a budget that fits your family's needs, keep an eye on your spending habits, and even find ways to save more.

Some budgeting apps also offer additional features like bill reminders, debt payoff plans, and investment tracking.

By giving you a clear picture of your financial situation, they make it easier for you to make informed decisions about your money.

The best part? Most of these apps are user-friendly, meaning you don't need to be a finance whiz to use them.

Top Budget Apps For Families

So now that we know one or two things about budgeting apps let's look at some of the top budget apps for families:

1. Mint

Price: Free/$4.99 per month

Mint is a popular app that helps families manage their money. It's made by the same company that makes QuickBooks and TurboTax.

With Mint, you can connect all your accounts like your bank, credit cards, and even subscriptions.

This gives you a clear picture of your money in one place. You can also make a budget, get tips tailored to your spending habits, and check your credit score for free.

Plus, it has some extra features like helping you reach your saving goals, lowering your bills, and canceling unwanted subscriptions.

And the best part? You can use all these features without seeing any ads.

2. HoneyDue

Price: Free

If you're looking for a budgeting app made specifically for couples, HoneyDue is your best bet. It's unique in that it allows for joint bank accounts.

With HoneyDue, you can link your bank accounts, loans, and investments from a wide range of over 20,000 financial institutions across five countries.

This helps you see all your money matters in one place. The app also lets you add your bills and sends you reminders to pay them on time, helping you avoid any late fees.

And the cherry on top - all these features come at absolutely no cost!

So if you are a family person and looking for a budgeting app that can help you manage your expenses and savings for free, give HoneyDue a try.

3. YNAB (You Need A Budget)

Price: $99 per year/$14,99 per month/34 days free trial

YNAB is an all-in-one budgeting app made specifically to help you gain control of your finances. Whether you are single or have a family, YNAB can help you achieve your financial goals.

You start by creating a budget and allocating every dollar to different categories like rent, groceries, utilities, etc.

The app also offers real-time syncing with bank accounts so you can see your progress as you spend.

Its simple interface and helpful features make it a favorite among many users.

Plus, with the paid version, you get access to personal finance classes, budgeting workshops, and expert support. It's secure, fun to use, and highly effective in helping you save money.

4. Goodbudget

Price: Free/$8 per month/$70 per year

Goodbudget is an innovative budgeting app that adopts the envelope-saving technique.

You and your partner can establish digital "envelopes" for various budget categories such as rent, groceries, or even a dream vacation. You allocate funds to each envelope every pay period.

When a bill is due, you withdraw from the corresponding envelope, and both of you get notified. The free version provides a single account, two-device access, and 20 envelopes in total.

For those needing more, the premium version offers unlimited accounts, five-device access, and limitless envelopes.

However, 20 envelopes per month may be enough for a family with one joint account, and the free version is definitely worth considering.

5. Pocketguard

Price: Free/$7.99 per month/$34.99 per year/$79.99 for life

PocketGuard is a user-friendly budgeting app that allows you to effortlessly sync your financial accounts.

With this app, you can easily track your bills and income, giving you a clear picture of your financial status. It offers insights and spending reports to help you manage your money better.

Additionally, it features cash tracking and budgeting tools at no extra cost.

For those aiming to pay off debt or save for something special, it also provides debt payoff plans, unlimited budgets, and unlimited savings goals. Plus, it ensures safe data transfer and storage.

One of the best parts about this app is its user-friendly interface - so whether you are tech-savvy or not, PocketGuard can easily fit into your lifestyle.

6. Every dollar

Price: Free/$12.99 per month/$79.99 per year

EveryDollar is a straightforward budgeting app designed to make financial management easier.

It allows you to set up a budget at no cost, helping you allocate your income efficiently. The app also includes a free savings fund feature, enabling you to set aside money for specific goals.

You can conveniently set bill due dates and split transactions, simplifying your financial tracking.

For an upgraded experience, EveryDollar offers bank synchronization and real-time transaction tracking, allowing you to stay on top of your spending.

It also features one-click transaction tracking for a quicker overview. Custom income and spending reports offer personalized insights into your financial habits.

The app also provides tracking recommendations and goal-tracking progress to help you stay motivated and reach your financial goals effectively.

7. Fudget

Price: Free/$14.99 per six-month/$19.99 per year

Fudget offers a unique, no-frills approach to budgeting. Its ultra-simple design is ideal for those who prefer not to sync financial accounts and enjoy a bare-bones, calculator-like interface.

With Fudget, you create lists of your income and expenses, and the app keeps track of your balances. It doesn't categorize expenses or offer insights, focusing instead on the basics.

The premium Plus version allows budget exporting and other additional features.

However, if you prefer detailed categorization, and insights, or don't want to manually log every expense, the budget might be too simplistic.

8. Empower Personal Wealth

Formerly known as Personal Capital, Empower Personal Wealth is predominantly an investment tool with helpful budgeting features included in its free app.

This tool allows you to connect and monitor various financial accounts such as checking, savings, credit cards, IRAs, 401(k)s, mortgages, and loans.

It provides a spending overview by listing recent transactions by category, which can be customized to suit your needs.

Moreover, it shows the percentage of total monthly spending each category accounts for. Empower also includes a net worth and portfolio tracker, accessible via both phone and desktop.

9. Rocketmoney

Price: Free/$3-$12 months

Rocket Money is a free budgeting application designed to help users manage their finances more efficiently.

It offers features like spending tracking, budget creation, automatic savings, bill negotiation, and subscription monitoring.

For those seeking additional services, a premium membership grants access to unlimited budgets, concierge services, and premium chat support.

Rocket Money is particularly beneficial for individuals keen on saving money on existing bills and keeping an eye on subscriptions.

One of its key advantages is its ability to negotiate bills on your behalf, potentially reducing your expenses. It can also identify and help cancel unwanted or outdated subscriptions.

However, be aware that some features are exclusive to the premium version, and Rocket Money does charge a fee for the money saved on negotiated bills.

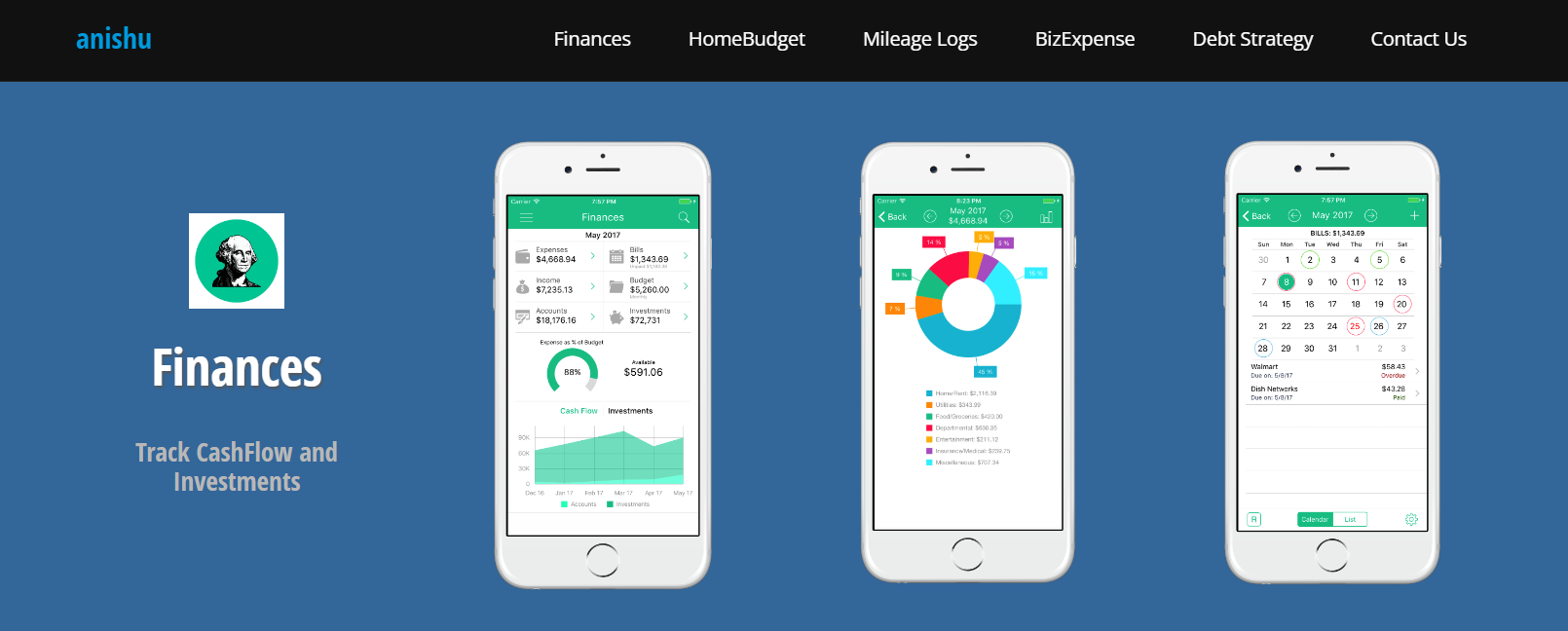

10. HomeBudget

Price: Free/$4.99 per month

HomeBudget is a comprehensive budgeting app that allows you to track regular expenses such as groceries, medical bills, and dining out.

It's especially useful for families as it can be synced across multiple devices, keeping everyone updated on family income and expenditure.

The app offers features like bill uploading, linking credit accounts directly, and searching for specific expenses.

You can also track your income, link it to the earner, and pay and track bills with reminders set on a calendar.

Expenses can be organized under specific categories and subcategories for precise tracking.

Visual options like pie charts and bar charts provide a quick overview of your spending, which can be exported via email.

What are the Benefits of Using Budget Apps?

There are so many benefits to using budget apps, especially for families - let's take a look at some of the most significant ones:

1. Simplifies Money Management

One of the biggest benefits of using budgeting apps is how they simplify the process of managing your finances.

Instead of having to manually record every income and expense, these apps automate the process by tracking your transactions in real time.

They categorize your spending into different buckets like groceries, rent, utilities, etc., giving you a comprehensive overview of where your money is going.

This not only saves you valuable time but also ensures accuracy in your financial records, making it easier for you to maintain a healthy budget.

2. Encourages Financial Discipline

Budgeting apps play a crucial role in promoting financial discipline.

By providing a clear and detailed picture of your income, expenses, and savings, these apps make you more aware of your spending habits.

You can easily see if you're overspending in certain areas and make necessary adjustments.

Furthermore, most budgeting apps allow you to set spending limits for different categories, helping you curb impulse purchases and stick to your budget.

Over time, this awareness and discipline can lead to significant financial improvements, including increased savings and reduced debt.

3. Easy Access to Financial Information

The convenience that budgeting apps offer is unmatched. They provide you with easy access to your financial data at your fingertips, no matter where you are.

Whether you're at home, at work, or on the go, you can check your financial status with just a few taps on your smartphone.

You can view your income, expenses, savings, and even debt levels in real-time, helping you make informed financial decisions.

This constant accessibility can be particularly useful in situations where you need to quickly assess your financial capability, like making a large purchase or planning a trip.

4. Goal-Setting and Tracking Features

Another important advantage of budgeting apps is their goal-setting and tracking features.

These apps allow you to set specific financial goals, such as saving for a vacation, buying a new car, or paying off a student loan.

Once you've set these goals, the app tracks your progress, showing you how close you are to achieving them.

This can serve as a powerful motivator, encouraging you to stay disciplined and focused on your financial plans.

Seeing your progress can also give you a sense of accomplishment and control over your finances, leading to better financial habits in the long run.

5. Automated Bill Reminders

Forgetting to pay a bill is a common issue that can lead to late fees and potential damage to your credit score.

Budgeting apps help mitigate this problem by providing automated bill reminders. You can set up these reminders for all your regular bills like rent, utilities, credit card payments, and more.

The app will then send you timely notifications, ensuring that you never miss a payment deadline.

This feature not only helps you avoid unnecessary penalties but also promotes better financial organization and peace of mind.

6. Insights and Recommendations

Budgeting apps do more than just track your income and expenses. They analyze your spending patterns and provide insightful feedback and personalized recommendations.

For example, if the app notices that you're spending a significant amount on dining out, it might suggest cooking at home more often to save money.

Or if you have unused subscriptions, the app might recommend canceling them.

These insights and recommendations can guide you towards smarter financial decisions, helping you maximize your savings and achieve your financial goals more effectively.

How to Pick the Right Budget App For Families?

Not every app is made equal, and the same goes for budgeting apps. Here are a few factors to consider when picking the right budget app for your family:

1. User-Friendly Interface

A budgeting app should not be a puzzle to solve. It should have a simple, clean, and intuitive design that anyone in the family can easily understand and use.

The process of adding incomes, and expenses, and setting budget goals should be straightforward and quick.

If an app is hard to navigate or overly complicated, it's likely that it won't be used consistently.

2. Multiple User Access

Budgeting is a family affair - hence, the chosen app should allow access to multiple users. This way, every family member can log in, add their expenses, and see the overall financial status.

This feature promotes transparency and ensures everyone is on the same page when it comes to the family's finances.

3. Security

When you're dealing with sensitive financial information, security is paramount. The budgeting app you choose should have robust security measures in place to protect your data.

This may include encryption, two-factor authentication, and secure servers. Always verify the app's security features and policies before you start entering your financial details.

4. Sync with Bank Accounts

A good budgeting app should be able to sync with your bank accounts. This feature allows for automatic tracking and categorization of income and expenses, reducing manual entry and potential errors.

It provides real-time updates on your financial status, helping you make informed decisions based on the most current data.

5. Cost

Budgeting apps come in both free and paid versions. It's important to consider the cost and whether the features offered are worth it.

Free apps can be great for basic budgeting needs, but they may lack advanced features or come with ads.

Paid apps generally offer more features like automatic syncing with bank accounts, detailed reports, and custom budget categories.

Before deciding, compare the costs and benefits of different apps to find one that offers good value for your family's budgeting needs.

Conclusion

So there you have it! If you are a family person and tired of losing control over your finances, these budgeting apps offer a convenient way to keep track of your money.

Choose the one that suits your needs and take charge of your financial future today!

Remember to always read reviews and compare prices before committing to a specific app, as each person's preferences and priorities may differ.